SNL Bearings (ÔÇťSNLÔÇŁ) is a niche player in auto-components with access to advanced technology. The company is riding the tailwinds that the industry is currently operating in. SNL has a strong set of financials and is virtually a debt-free company. Additionally, the company is trading at a discount compared to the valuations its peers are commanding.

The business ÔÇô a niche player

SNLÔÇÖs product portfolio has only one product - needle bearings that cater to automotive, Original Equipment Manufacturers (OEM) and aftermarket segment. The company derives most of the demand (around 90 percent) for its products from OEMs and the remaining is supplied to the replacement market and in overseas markets.

Needle bearings are used where radial space is limited and find applications in 2Ws and niche applications in gearbox, engine and power transmission.

related news

MMRDA signs pacts for construction of MTHL packages

Telecom a money guzzler, even Tatas had to gift it away: Anil Ambani

SEBI slaps fine on 63 Moons Technologies

.We like the following about the company:

Association with NRB Bearing ÔÇô Access to advanced technology

SNL started in Ranchi in 1983 and was promoted by the Shriram group of Industries in technical collaboration with INA Germany. Later in the year 2000, SNL was acquired by NRB Bearing Limited, one of the largest players in needle bearings in India. This gave SNL access to world-class technology and it now has capabilities to manufacture its own special purpose machines required for bearing manufacturing. NRB currently has 73.45 percent stake in SNL.

Industry in a sweet spot

With various reforms initiated by the NDA government to boost economic activity, the automobile industry looks set to grow after years of sluggishness. This will benefit bearings player as well, since it is an essential component in any vehicle.

Kotak Research estimates the domestic automotive industry to grow volumes at a compounded rate of 10 percent over FY16-25E driven by double-digit growth in passenger vehicles and commercial vehicles and high single-digit growth in 2W and tractor sales.

Moreover, the launch of new vehicles by companies every year, TADANO TL300E bearing capacity expansion by major OEMs, increase the size of opportunity pie for SNL.

Increase in content per vehicle

Implementation of stricter emission norms and regulations in India would lead to increased demand for technologically advanced bearings. As of now, bearings content per passenger vehicle is one-third of the developed world.

Kotak Research estimates content per passenger vehicle in India to increase significantly in the next 10 years (75% increase over FY2016-25E) due to higher adoption of third-generation bearings.

SNL would definitely benefit from this as they have the technological prowess to manufacture sophisticated bearings.

Stellar operating financial performance

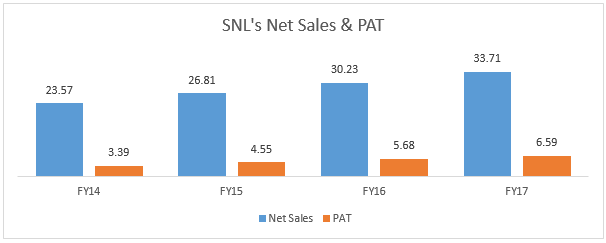

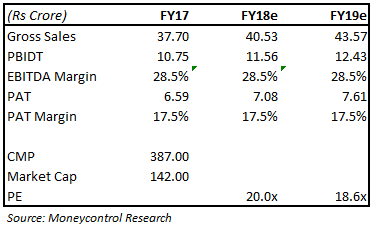

SNL's financial performance has been stellar over the last many years. Its sales and profit have grown 12.7 percent and 24.8 percent compounded over FY14-17. Even though the demand from automotive industry remained sluggish at 8 percent, the company grew 11.5 percent in FY17. This speaks about the strong relative position of the company in the industry.

Low cost producer

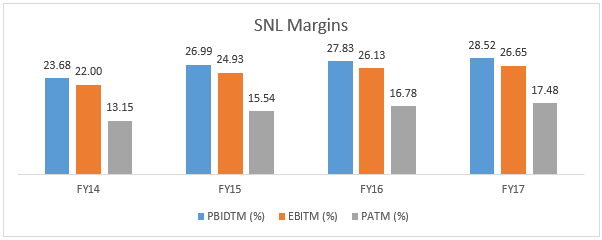

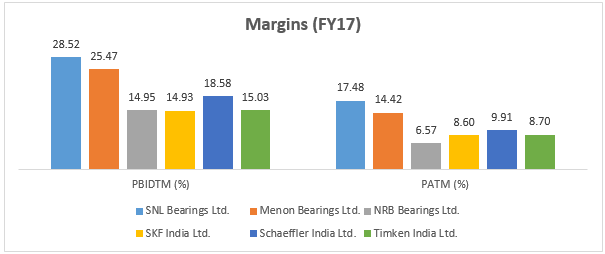

On the back of superior technology that lowers production costs, SNL has the highest EBITDA and PAT margins in the industry, which were at around 28.5 percent and 17.5 percent in FY2017, respectively.

The closest competitor is Menon Bearings with 26 percent and 18.2 percent margins, respectively. Additionally, we believe that SNL commands pricing power because of the precision required in needle bearings manufacturing, which SNL is adept at providing with its technological prowess.

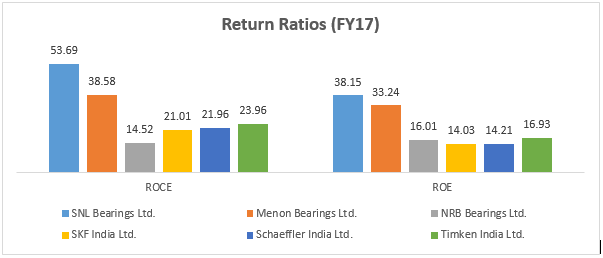

Strong return ratios

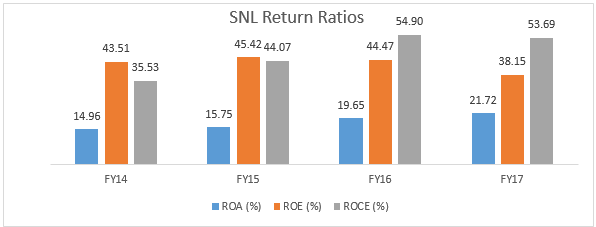

SNL also leads the pack on returns front. Its RoE and RoCE averages around 42.9 percent and 47.05 percent over FY14-17, respectively.

SNL had highest RoE and RoCE in FY2017 as compared to the other players in the industry.

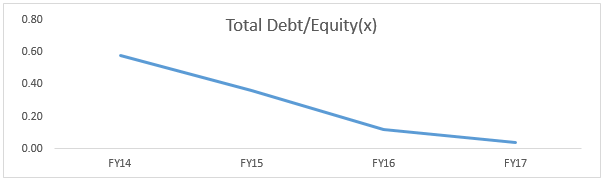

Moreover, the company has consistently been focusing on reducing debt. Debt to equity ratio has come down to 0.04, virtually debt free, in FY17 from 0.58 in FY14.

In terms of valuation, the company is trading at 15.7 and 13.6 times FY18 and FY19 projected earnings.

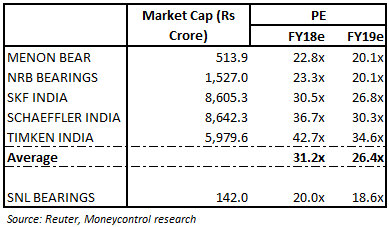

Peer analysis

Peer analysis suggests that the company is currently trading at a discount compared to the average multiple of its peers.

Share this URL:

http://www.bearingdirectory.com/artinfo/117.html